Job Oriented Accounting Course in Delhi

Delhi offers a wide range of job-oriented Accounting Course in Delhi designed to equip students and professionals with practical skills in accounting, GST, and income tax. These programs are tailored for fresh graduates, working professionals, and entrepreneurs aiming for a strong foundation and career advancement in finance, taxation, and business analysis.

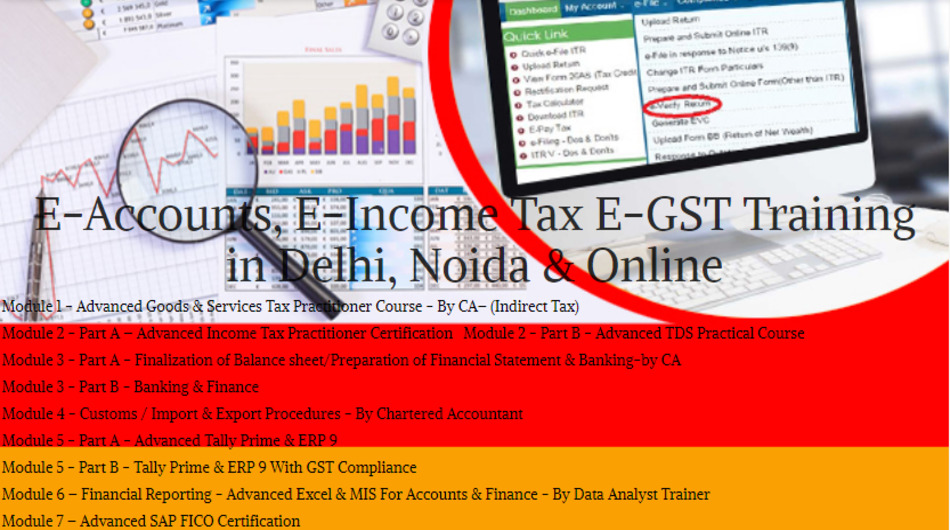

Job Oriented Accounting Course in Delhi, GST and Income Tax Course in Delhi

Key Features of Leading Accounting Courses:

-

Comprehensive Curriculum: Courses typically cover core accounting principles, finalization of balance sheets, preparation of financial statements, banking, payroll, and advanced modules in Tally Prime, ERP 9, and SAP FICO.

-

GST and Income Tax Focus: Specialized modules on GST (Goods and Services Tax) and Income Tax include GST registration, invoicing, e-way bills, returns filing, TDS/TCS, and the latest amendments.

-

Practical Training: Hands-on sessions with real-time projects, assignments, and live case studies using industry-standard software like Tally, SAP FICO, and Advanced Excel.

-

Industry Expert Faculty: Training is delivered by experienced Chartered Accountants and finance professionals with deep industry exposure.

-

Placement Support: Institutes such as SLA Consultants India and ICA Edu Skills provide 100% job or interview guarantees, placement assistance, and career counseling for roles like Accounts Executive, Manager, and Sr. Accountant.

-

Flexible Learning: Options for online, offline, weekday, and weekend batches are available to suit different schedules.

-

Eligibility: Most courses are open to graduates, commerce students, and working professionals. Some short-term certifications accept 12th pass candidates.

GST and Income Tax Course in Delhi

Course Structure & Learning Outcomes:

-

GST Modules: Cover basics to advanced GST concepts, registration, input tax credit, composition scheme, GST returns (monthly/quarterly/annual), invoicing, e-way bills, payments, refunds, and compliance with the latest updates.

-

Income Tax Modules: Include fundamentals of income tax, computation of taxable income, e-filing of returns, TDS/TCS compliance, challan generation, and payment processes.

-

Software Training: Emphasis on Tally ERP 9 with GST compliance, SAP FICO, and advanced Excel for MIS reporting and financial analysis.

-

Auditing and Reporting: Some programs add modules on auditing, internal controls, and preparation of statutory reports.

-

Live Projects: Exposure to real industry scenarios, client projects, and assignments to develop job-ready skills.

Popular Institutes in Delhi:

-

SLA Consultants India: Known for its e-Accounting and E-Taxation Practical Training Course, offering advanced modules, real-time assignments, and a 100% interview guarantee.

-

NIFM: Offers a Certified Accounts Professional Course with in-depth modules on accounting, GST, income tax, and Tally ERP .

-

ICA Edu Skills: Provides the Certified Industrial Accountant (CIA) course with practical training in accounts, GST, income tax, TallyPrime, and SAP FICO, along with job placement.

-

IFDA and University of Delhi (School of Open Learning): Offer short-term GST and accounting courses with practical exposure and recognized certification.

Job Oriented Accounting Course in Delhi, GST and Income Tax Course in Delhi

Career Prospects

After completing these courses, candidates can pursue roles such as:

-

Accounts Executive/Manager

-

GST Practitioner

-

Income Tax Consultant

-

Financial Analyst

-

Payroll Manager

-

SAP FICO Specialist

These certifications significantly enhance employability in MNCs, corporate finance departments, and consulting firms, and also support entrepreneurship in accounting and tax consultancy.

For those planning to start a business or seeking job opportunities in finance, accounting, and data analysis, these job-oriented courses in Delhi provide the practical skills and recognized certifications needed for a successful career.

https://slaconsultantsdelhi.in/training-institute-accounting-course/

https://slaconsultantsdelhi.in/gst-course-training-institute/

Accounting, Finance CTAF Course

Module 1 – Advanced Goods & Services Tax Practitioner Course – By CA– (Indirect Tax)

Module 2 – Part A – Advanced Income Tax Practitioner Certification

Module 2 – Part B – Advanced TDS Practical Course

Module 3 – Part A – Finalization of Balance sheet/Preparation of Financial Statement & Banking-by CA

Module 3 – Part B – Banking & Finance

Module 4 – Customs / Import & Export Procedures – By Chartered Accountant

Module 5 – Part A – Advanced Tally Prime & ERP 9

Contact Us:

SLA Consultants Delhi

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No.52,

Laxmi Nagar, New Delhi – 110092

Call +91- 8700575874

E-Mail: [email protected]

Website: https://slaconsultantsdelhi.in/